Oral care Toothpaste industry, from linear to circular

Executive summary

Toothpaste industry is a high growing industry worldwide and more precisely in the emergent markets. The rise in consciousness of oral health has helped vendors introduce different oral hygiene product categories for global customers and professionals. This industry generates high level of waste due to non-recyclable parts and products. Thus, for this study we choose to focus on the linear business model of toothpaste tube.

This report analyzes, in the first part, the current business model of Colgate-Palmolive toothpaste tube industry and how it affects badly the environment and how it generates several negative externalities. It explores also how and where a circular business model can be introduced in order to upgrade the present business model. The report uses the EMF butterfly model as a framework to establish the level of circularity can introduce in the linear model.

In the second part, the new circular business model, built on a high-level interaction with the final customers, will be detailed as a second alternative of the linear business model. Then, we will analyze the different strategies based on the advanced SWOT analysis results.

Finally, to have a global overview we will provide a high-level financial analysis supporting the new business model.

Introduction

Toothpaste is a paste or gel to be used with a toothbrush to maintain and improve oral health and aesthetics. Toothpastes contain abrasives to clean and whiten teeth, flavors for the purpose of breath freshening and whiteness better visual appeal. Using toothpaste when brushing is the primary step to proper oral hygiene. Fluoride with correct brushing will remove dental bacteria and plaque.

Today, toothpastes are produced to serve multiple purposes at the same time and, thus, possess a complex chemical composition. The ideal toothpaste must have the following properties: slight abrasion, froth, sweetening, bleaching and prevention of plaque, calculus and decay.

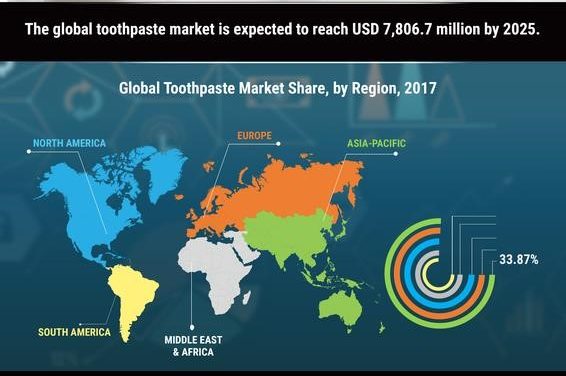

The global toothpaste market is projected to grow at a CAGR of 6.1% during the period 2016-2024. Increasing dental problems among children and adults, due to poor eating habits, and the rise in popularity for herbal oral care products are the factors primarily driving the toothpaste market. Moreover, rising premiumization and consumers seeking more targeted solutions are accelerating the growth of the market.

The rise in consciousness of oral health has helped vendors introduce oral hygiene product categories, like teeth-whitening products. One of the popular products used for teeth whitening is whitening toothpaste. Manufacturers offer toothpaste with teeth-whitening functionality that differs from ordinary toothpaste.

Figure 1: Global Toothpaste Market, By Region, 2017

Based on the regional analysis, the global toothpaste market namely tags North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Asia (MEA). The APAC region accounted for a major market share in 2017 thanks to the burgeoning population in two of the biggest economies, China and India. In addition, awareness of oral hygiene combined with presence of international brands is likely to fuel market growth in the region ((MRFR), 2019)

Colgate-Palmolive is the world leader in term of market share, based on markets where they compete and purchase shares. (colgatepalmolive, 2019). In this study, we will focus on Colgate-Palmolive Toothpaste products, in order first to explain the current business model and the different externalities linked to this industry.

Colgate-Palmolive toothpaste business model

Business

Colgate-Palmolive Company (together with its subsidiaries, the “Company” or “Colgate”) is a leading consumer products company whose products are marketed in over 200 countries and territories throughout the world. Colgate was founded in 1806 and incorporated under the laws of the State of Delaware in 1923.

The Company operates in two product segments: Oral, Personal and Home Care; and Pet Nutrition. Colgate is a leader in Oral Care with global leadership in the toothpaste and manual toothbrush categories throughout many parts of the world according to market share data.

Colgate’s Oral Care products include more than 13 products. Colgate’s Oral Care business also includes pharmaceutical products for dentists and other oral health professionals.

Colgate manufactures and markets a wide array of products for the Home Care market, including Palmolive and Ajax dishwashing liquids and Fabuloso, Murphy’s Oil Soap and Ajax household cleaners. Colgate is a market leader in fabric conditioners with leading brands, including Suavitel in Latin America, Soupline in Europe and Cuddly in the South Pacific according to market share data.

Sales of Oral, Personal and Home Care products accounted for 47%, 20% and 18%, respectively, of the Company’s total worldwide Net sales in 2018. Geographically, Oral Care is a significant part of the Company’s business in Asia Pacific, comprising approximately 82% of Net sales in that region for 2018.

Distribution, Raw Materials and Competition

The Company’s Oral, Personal and Home Care products are sold to a variety of traditional and e-commerce retailers, wholesalers and distributors worldwide.

Pet Nutrition products are sold by authorized pet supply retailers, veterinarians and e-commerce retailers. The Company’s sales to Wal-Mart, Inc. and its affiliates represent approximately 11% of the Company’s Net sales in 2018. No other customer represents more than 10% of the Company’s Net sales.

The Company supports its products with advertising, promotion and other marketing (including digital) to build awareness and trial of the Company’s products. The Company’s products are marketed by a direct sales force at individual operating subsidiaries or business units, and by distributors or brokers.

The majority of raw and packaging materials used in the Company’s products is purchased from other companies and are available from several sources. No single raw or packaging material represents, and no single supplier provides, a significant portion of the Company’s total material requirements.

For certain materials, however, new suppliers may have to be qualified under industry, governmental and Colgate standards, which can require additional investment and take some period of time. Raw and packaging material commodities such as resins, pulp, essential oils, tropical oils, tallow, poultry, corn and soybeans are subject to market price variations.

The Company’s products are sold in a highly competitive global marketplace which has experienced increased trade concentration, the rapid growth of e-commerce, the integration of traditional and digital operations at key retailers and the growing presence of large-format retailers and discounters. Products similar to those produced and sold by the Company are available from multinational and local competitors in the U.S. and overseas.

Certain of the Company’s competitors are larger and have greater resources than the Company. In certain geographies, particularly in the emerging markets, the Company also faces strong local competitors, who may be more agile and have better local consumer insights than the Company. Private label brands sold by retailers are also a source of competition for certain of the Company’s products.

The retail landscape in many of the Company’s markets continues to be impacted by the rapid growth of e-commerce retailers, changing consumer preferences (as consumers increasingly shop online) and the emergence of alternative retail channels, such as subscription services and direct-to-customer businesses. The Company faces competition in several aspects of its business, including pricing, promotional activities, new product introductions and expansion into new geographies and channels. Product quality, innovation, brand recognition, marketing capability and acceptance of new products largely determine success in the Company’s operating segments.

(Colgate-Palmolive, 2018)

Manufacture of Toothpaste

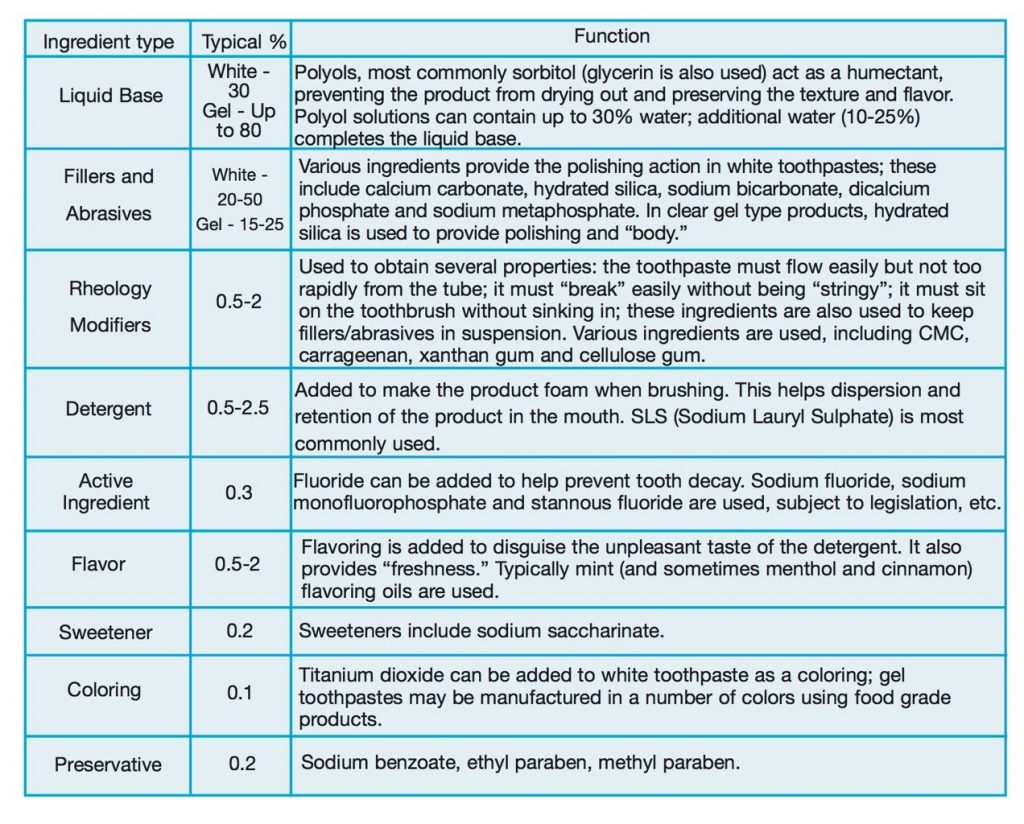

Toothpastes are generally either white abrasive pastes or clear gels. Although the formulations differ, they share many common ingredients; these may vary from country to country according to legislation on use of ingredients, etc.

Typical ingredients and their function are shown in the table:

Figure 2 : Typical ingredients and their function

The Manufacturing Process

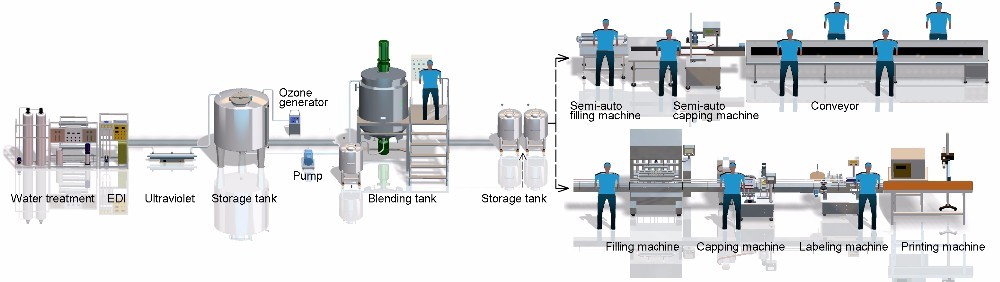

Processing methods vary depending on the product type and ingredients used. A typical process could be described as follows:

- The liquid base is prepared first – water, sorbitol/glycerin and other liquid ingredients.

- Rheology modifiers may be pre-mixed with a non-aqueous liquid ingredient such as glycerin or the flavoring oil, or dry blended with other powdered ingredients to aid dispersion.

- The active ingredient, sweetener and preservative are added and dispersed.

- The abrasive/filler is then added. This may be supplied as a slurry, or premixed with part of the water prior to blending with the liquid base.

- Flavoring and coloring are added.

- The detergent is added last under slow speed agitation to minimize foaming. It is typically in solid form to avoid adding water to the formulation at this stage.

( (www.silverson.com, 2019)

Filling the tubes

- Before tubes are filled with toothpaste, the tube itself passes under a blower and a vacuum to ensure cleanliness. Dust and particles are blown out in this step. The tube is capped, and the opposite end is opened so the filling machine can load the paste.

- After the ingredients are mixed together, the tubes are filled by the filling machine. To make sure the tube is aligned correctly, an optical device rotates the tube. Then the tube is filled by a descending pump. After it is filled, the end is sealed (or crimped) closed. The tube also gets a code stamped on it indicating where and when it was manufactured.

Figure 3 :The Manufacturing Process

Packaging and shipment

- After tubes are filled, they are inserted into open paperboard boxes. Some companies do this by hand.

- the boxes are cased and shipped to warehouses and stores.

Quality Control

Each batch of ingredients is tested for quality as it is brought into the factory. The testing lab also checks samples of final product.

Externalities

LINEAR LIFE CYCLE

Tube packaging lowered the price of toothpaste and spawned the U.S. dentifrice industry. In 2015 toothpaste was the eighth leading health and beauty product category in the United States, with sales that generated approximately 2.97 billion U.S. dollars. Unfortunately, small size, blended material and leftover toothpaste inside toothpaste tubes often make recycling almost impossible. The tubes can be recyclable if they are made of only one material (aluminum or plastic) but the truth is that today they are often packaged as a mix of different materials. Most curbside recycling programs do not accept these tubes. Plastic used is also not biodegradable and can take anywhere from 500 to 700 years to break down. That is why today’s toothpaste tubes have mostly linear life cycle – and not a circular one.

Environmental impact

It is estimated that 400 million toothpaste tubes are discarded every year in the United States only. On the global level, that number raises up to 1.5 billion discarded toothpaste tubes. Also, roughly 8 million tons of different kinds of plastic end up in the ocean annually. A large part of the problem is littered waste, but it’s worth considering how a switch from using plastic goods that require landfilling or specialized recycling to ones that are biodegradable, compostable or zero-waste could reduce the possibility of polluting land and sea.

- 1,5 billion (50%) of empty tubes end up in the landfills every year

- 8 million ton of plastic end up in the ocean yearly

- By 2050 there will be more plastic than fish in the oceans

- Plastic used in the tubes needs up to 700 years to dissolve

Designing toothpaste with sustainable and fully recyclable packaging is the only way to reduce waste going to landfills and oceans. By using new technologies and smart design we could save both the water and energy involved in the production, transportation and disposal of these products.

From a Linear to a Circular business model

How and where to introduce a circular business model?

We explained in the previous chapters the current linear business model of Toothpaste industry. The circularity can be introduced in the recycling, manufacturing and distribution parts of the linear business model. Still, the collection of empty tubes is a not clearly defined.

In our case, we will introduce several additional steps to make the model more circular and to create value for Colgate-Palmolive and their customers. For this purpose, we will use the EMF butterfly model, before describing our full solution.

EMF butterfly model

(CirculareconomyToolkit, 2019)

Figure 4 : Level of circularity based on EMF butterfly framework

Toothpaste tube is a part of the final product “Toothpaste”. So, based on the EMF Framework the level of circularity of this product is in the recycling part. Indeed, the tubes can be recyclable if they are made of only one material (aluminum or plastic) but the truth is that today they are often packaged as a mix of different materials. In these conditions, a recyclable tube, made of only one material, can increase the circularity of the business model. Colgate-Palmolive have worked during the last years on a 100% recyclable tube.

The transformation of the business model to a new one who integrates services instead of selling only a final product will allow us to reduce the negative externalities and the waste.

We can also transform the model to product as a service and change the share level. This the main idea we will try to explain our circular business model.

Circular business model

Colgate-Palmolive’s current toothpaste business model is linear which it means that it causes a lot of waste and serious environmental impacts. In January 2020 Colgate announced its first 100% recyclable toothpaste tube. The financial impact of this new invention is not yet clear. Still, one of the solutions is that regulators impose this new product as a standard to all toothpaste tube manufacturers. Of course, we are aware that, this is not a viable solution if regulators are not agree. Yet, it is one of the solutions to help Colgate-Palmolive new product to be used in larger scale.

For the purpose of this study, and using this new first toothpaste 100% recyclable brevet’s, we are convinced that the following circular business model could be a good alternative to reduce waste, and to increase a positive impact on the environment and on the business itself .

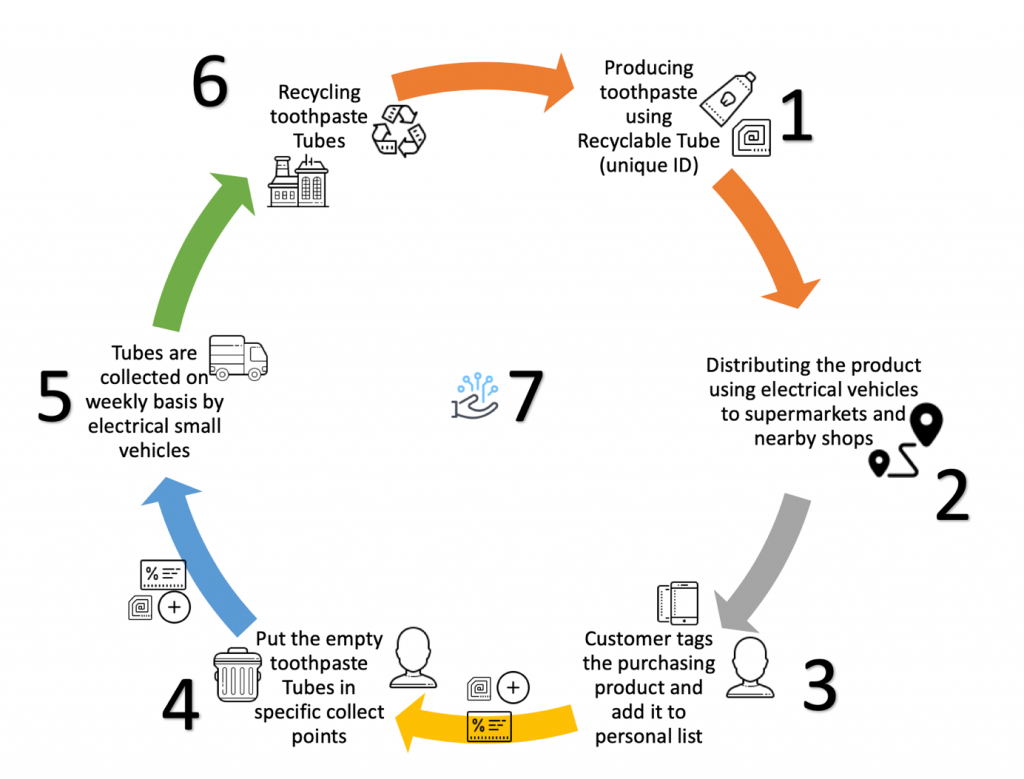

Figure 5: Toothpaste’s Circular business Model

The suggested business model uses basically the new 100% recyclable tube as a key element of the circular business strategy. To each produced tube (originally or based on recyclable row materials) we add a unique identifier: bar code, serial number of even a REFID. The idea is to be able to follow the product’s life cycle from production phase, distribution phase, consumption phase, collect phase and finally recycling phase.

The previews schema illustrates the 7 steps of our circular business model:

- Production

- Distribution

- Consumption and customer interaction

- Sorting products

- Collection phase

- Recycling

- Information system and Data Analytics

The production phase as we described previously, is based on new or recycling row materials. 1). The important step in production is to tag each product with a unique identifier. 2). Then, in the distribution phase, the same current distribution channels will be used: Supermarkets, nearby shops, and pharmaceutical stores. We suggest to use electrical vehicles to reduce the CO2 footprint. Yet, electrical vehicles are not mandatory in our business model. 3) The consumption and customer interaction phase is crucial. Indeed, the business model is based on a high interaction with customer via a mobile or website application. The customer tags all the products he bought and add them to its annual or monthly shopping list. This interaction allows the company through its loyalty program to give incentives, reductions or promotions to each customer. 4) To get more loyalty points and more reductions the customer should regularly sort his empty toothpaste tubes and put them in the specific collect points. Usually the collect points will be near or in the distribution points: Supermarkets, nearby shops, and pharmaceutical stores. 5) The empty tubes are collected in a weekly basis by small electrical vehicles. Once again, the electrical aspect is a nice way to reduce the CO2 footprint but it’s not mandatory. 6) The collected empty tubes are sorted and scanned in the recycling phase. Thanks to the tube’s unique identifier, the customer will earn more loyalty points for each recycling product tagged in his personal shopping list. 7) Finally, the last step in our model, is the data collection and analytics by our information system. Based on the collected data, we can predict the sales size, the active regions, customer habits and preferences and transform the production or the distribution size based on the real demand (almost in real time). In this model, data collection and analytic will allow the company to also promote its circular model. I will increase the customer loyalty throw personalized campaigns and promotion or via incentives.

SWOT analysis for this new model

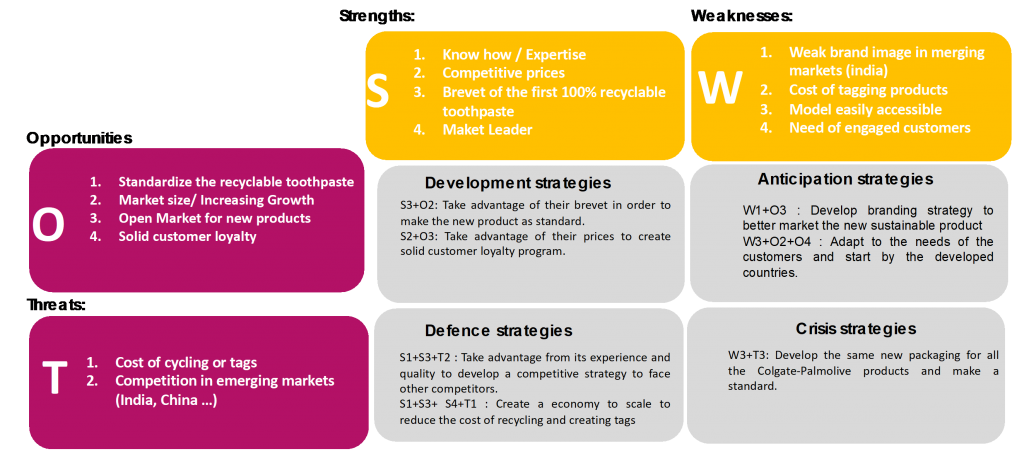

The advanced SWOT analysis of the new model allow us to define several strategies based on the strengths and opportunities. Still, need also to consider the threats and weaknesses in order to define clearly the defense and crisis strategies.

Development strategies

One the of strengths of Colgate Palmolive is competitive prices, because the own already the brevet of the first 100% recyclable tube. So, in market size with an increasing Growth the circular model allows the company to take advantage of their brevet in order to make the new product as standard. The can also Take advantage of their prices to create solid customer loyalty program.

Anticipation strategies

The market is opened for new product, the company could use this opportunity to face the weak brand image in emerging markets (India) by developing a branding strategy to better market the new sustainable product.

The suggested model is easily accessible by its competitors, so the company should use the market size and increasing growth to adapt to the needs of the customers and start by the developed countries.

Defense strategies

Colgate- Palmolive master the know-how, they have large expertise in the industry and they own brevet of the first 100% recyclable toothpaste. So, the can take advantage from its experience and quality to develop a competitive strategy to face other competitors, especially in the emergent countries.

The can also create an economy of scale to reduce the cost of recycling and creating tags.

Crisis strategies

To face the clone of this easily accessible model, Colgate-Palmolive should develop the same new packaging for all the Colgate-Palmolive products and make a standard.

Figure 6: SWOT analysis for this new model

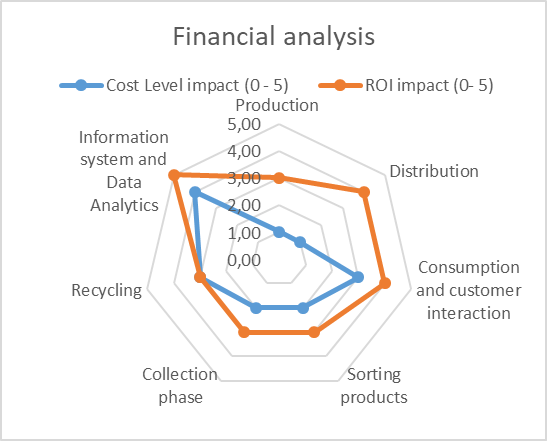

Financial analysis supporting the new business model

The new suggested circular business model is composed 7 steps

- Production

- Distribution

- Consumption and customer interaction

- Sorting products

- Collection phase

- Recycling

- Information system and Data Analytics

The distribution and collection channel will be made using the same process. Thus, the financial cost is very low for this part.

The cost of adding a unique reference identifier to each tube is very low. Based on our research the cost of production a toothpaste tube is 0,3$ to 2$ per tube (China, 2020) depending on the ordered quantity, so adding a printed reference identifier should not increase the cost considerably.

The big part of investment concerns the consumption and customer interactions, Sorting products, Recycling and finally design the information system and data analytics model. The suggested model, engage the customer and generate high level of interaction, loyalty and interest for the company and its customers.

Consumers are more aware of environmental impact of the toothpaste industry, and using the new circular model, they can embrace the change and accept a first increase on tube sale’s price knowing that they will benefit from promotion and reductions based on their purchases and loyalty.

| Step | Cost Level impact (0 – 5) | ROI impact (0- 5) |

| Production | 1 | 3 |

| Distribution | 1 | 4 |

| Consumption and customer interaction | 3 | 4 |

| Sorting products | 2 | 2 |

| Collection phase | 2 | 2 |

| Recycling | 3 | 3 |

| Information system and Data Analytics | 5 | 5 |

*0 low – 5 Very high

To conclude, we need to develop a detailed financial analysis based on those different factors. Still, the data collection and analytics can generate a highly competitive advantage for Colgate-Palmolive in term of additional services they can create.

Conclusion and insights

Looking beyond the current linear business model in the toothpaste industry, the suggested circular economy business model aims to redefine growth, focusing on positive society-wide benefits for the Colgate-Palmolive and its customers. It enables gradually to decouple industrial activity from the consumption of the finite resources, and designing waste out of the system.

In this report, we tried to build a new circular model using the recent 100% recyclable toothpaste tube to serve the economic, natural, and social capital.

Still, the suggested business model should be more detailed in term of financial analysis to have a global viable business.

This concept could also be generalized to the other industries using tubes (pharmaceutical, cosmetics, etc.), but regulation should help the companies by standardizing and imposing the use of 100% recyclable part in different industries.

Bibliography

(MRFR), M. R. (2019, 01 26). Market Research Future (MRFR). Retrieved from Global Toothpaste Market: https://www.marketresearchfuture.com/reports/toothpaste-market-7221

China, M. i. (2020, 02 20). Made in China. Retrieved from Made in China – Product Directory: https://www.made-in-china.com/productdirectory.do?word=toothpaste+Tube&file=&subaction=hunt&style=b&mode=and&code=0&comProvince=nolimit&order=0&isOpenCorrection=1

CirculareconomyToolkit. (2019, 07 01). circulareconomytoolkit.org. Retrieved from circular economy toolkit Assessmenttool: http://circulareconomytoolkit.org/Assessmenttool.html

Colgate-Palmolive. (2018). Colgate-Palmolive Annual Report 2018. Colgate-Palmolive.

colgatepalmolive. (2019, Novembre 01). investor colgatepalmolive . Retrieved from investor colgatepalmolive : https://investor.colgatepalmolive.com/static-files/a65490ac-2442-41e3-8751-e18a1471bd92

Mordor intelligence. (2020, 01 25). TOOTHPASTE MARKET – GROWTH, TRENDS, AND FORECAST (2020 – 2025). Retrieved from Mordor intelligence: https://www.mordorintelligence.com/industry-reports/toothpaste-market

www.silverson.com. (2019). www.silverson.com. Retrieved from www.silverson.com: https://www.silverson.com/us/resource-library/application-reports/manufacture-of-toothpaste